Dental Places That Take Payments: 3 Easy Ways

Why Finding Dental Places That Accept Payment Plans Matters for Your Oral Health

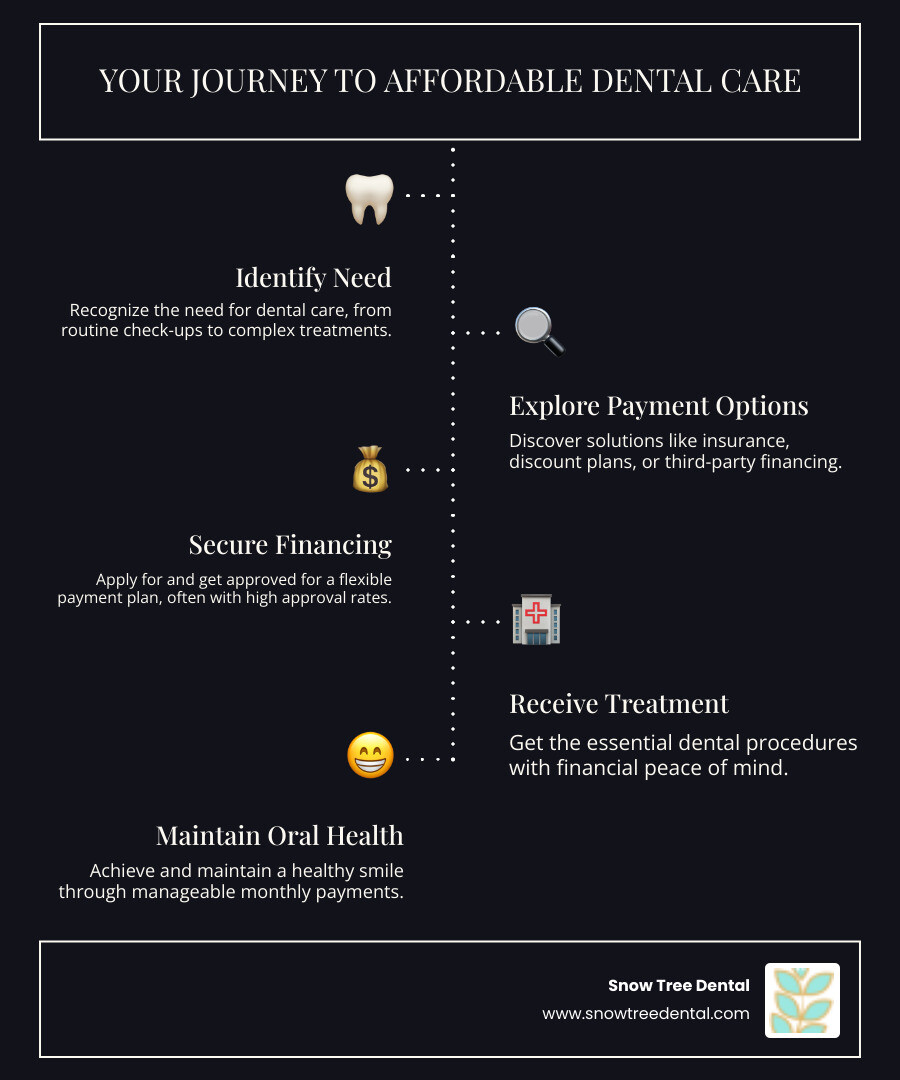

Dental places that take payments offer flexible financing solutions that make quality dental care accessible to everyone, regardless of their current financial situation. Here are the main payment options available:

- Dental Insurance – Traditional coverage with co-pays and deductibles

- In-House Discount Plans – Annual membership plans starting as low as $149/year

- Third-Party Financing – Healthcare credit cards and personal loans up to $75,000

- Buy Now, Pay Later Services – Split payments into manageable installments with high approval rates (up to 99%)

- Traditional Payment Methods – Cash, credit cards, and HSA/FSA accounts

The cost of dental care can feel overwhelming. A simple dental crown ranges from $697 to $1,399, while dental implants can cost anywhere from $642 to $12,474. These numbers often cause people to delay necessary treatment, which can lead to more expensive problems down the road.

Modern payment solutions have changed everything. Today’s dental financing options offer approval rates as high as 87-99%, with many patients qualifying for 0% interest plans. Some services can approve patients in as little as 60 seconds, making it easier than ever to say “yes” to the care you need.

The good news is that most dental practices now understand that flexible payment options increase patient satisfaction and treatment acceptance. Research shows that offering financing can increase case acceptance by 30% and help practices serve more patients who might otherwise go without care.

As Dr. Muna Mohammad at Snow Tree Dental, I’ve seen how payment flexibility removes barriers to essential dental care and helps families maintain their oral health without financial stress. My experience working with various dental places that take payments has shown me that the right financing solution can make all the difference in a patient’s treatment journey.

Your Guide to Common Dental Payment Options

Let’s be honest – dental places that take payments exist because we all know that dental care can be expensive. The good news? There are more ways than ever to make quality dental care fit your budget.

Payment flexibility is what separates modern dental practices from the old days when you had to pay everything upfront. Today’s patients have multiple solutions to manage dental costs, from traditional insurance to innovative financing options that can get you the care you need right away.

Think of it this way: you wouldn’t buy a car without exploring financing options, so why should dental care be any different? Whether you’re dealing with a surprise root canal or planning that smile makeover you’ve been dreaming about, the right payment plan can make all the difference.

Paying with Dental Insurance

If you have dental insurance, you’re already ahead of the game. But understanding how it works can save you money and prevent surprises at checkout.

Co-pays are the fixed amounts you pay at each visit – think of them as your “entry fee” for covered services. Deductibles work like your car insurance: you pay a certain amount out of pocket before your coverage kicks in.

Here’s where it gets tricky: annual maximums. Most dental insurance plans cap how much they’ll pay per year, typically between $1,000-$2,000. Once you hit that limit, you’re on your own until the next benefit period starts.

In-network versus out-of-network providers can make a huge difference in your wallet. In-network dentists have agreed to specific rates with your insurance company, which usually means lower costs for you. Out-of-network providers might charge more, and your insurance might cover less.

Most plans follow the 100-80-50 rule: preventive care (cleanings, exams) at 100%, basic procedures (fillings) at 80%, and major work (crowns, root canals) at 50%. We work with most major insurance plans to help you maximize these benefits.

For detailed information about how we handle insurance, check out our Insurance Information page.

In-House Dental Discount Plans

What if you don’t have insurance? Or what if your insurance doesn’t cover what you need? That’s where in-house dental discount plans shine.

These aren’t insurance – they’re something better in many ways. You pay an annual fee (ours starts at just $149 per year for the whole family), and you get percentage discounts on all your dental services. No paperwork, no claim denials, no waiting periods.

The beauty of these plans is their simplicity. No deductibles mean you start saving from day one. No annual maximums mean you can get all the care you need without hitting a wall. No waiting periods mean you can use your benefits immediately – perfect for dental emergencies.

These plans are ideal for uninsured patients, but even people with insurance sometimes find them more predictable and cost-effective. Family plans cover everyone under one roof, making budgeting easier.

Want to see how much you could save? Learn about our Dental Plan and find why so many Houston families choose this option.

Third-Party Financing and Payment Plans

Sometimes you need dental work now but don’t have thousands of dollars sitting in your checking account. That’s where external lenders come to the rescue.

These financing options let you spread costs over time through manageable monthly payments. Instead of paying $3,000 upfront for a crown, you might pay $150 a month for two years. It’s the same concept as financing a car or home improvement project.

Interest rates vary depending on your credit and the lender, but many offer promotional periods with 0% interest if you pay within a certain timeframe. We’ve helped patients finance everything from routine care to full mouth reconstructions – up to $75,000 with terms up to 144 months.

The application process is usually quick and can often be completed right in our office. Many patients get approved in minutes, so you don’t have to delay necessary treatment.

Ready to explore your options? Visit our Finance Options page to see what’s available.

How Do Dental Places That Take Payments Structure Third-Party Financing?

When you’re facing a significant dental treatment, the last thing you want to worry about is how you’ll pay for it. That’s where dental places that take payments really shine – they’ve done the heavy lifting by partnering with trusted third-party financing companies to make the process as smooth as possible for you.

The beauty of these partnerships is that you can handle everything right there in the dental office. No need to research lenders on your own or fill out multiple applications. The application process is typically straightforward – often taking just a few minutes – and approval rates are remarkably high. Many patients are surprised to learn they qualify for financing even when they weren’t sure they would.

What makes these financing options particularly appealing is the variety of loan terms available. Whether you need a few months to pay off a crown or several years for a complete smile makeover, there’s likely an option that fits your budget. And here’s the really exciting part: many of these plans offer interest-free promotional periods, meaning you could potentially pay zero interest if you meet the terms.

Healthcare-Specific Credit Cards

Think of healthcare credit cards as your regular credit card’s specialized cousin – one that’s designed specifically for medical and dental expenses. These cards have become incredibly popular because they offer something most regular credit cards don’t: promotional financing periods with 0% interest.

Here’s how they work in practice. Once you’re approved, you have a revolving credit line that you can use for dental care and other healthcare expenses. The real advantage comes with the promotional offers – you might get 6, 12, or even 24 months with no interest on purchases over a certain amount, as long as you make your minimum monthly payments.

But here’s something important to understand about deferred interest. If you pay off your entire balance before that promotional period ends, you pay zero interest – fantastic! However, if there’s still a balance when the promotion expires, you could be charged interest retroactively from the day of your original purchase. It’s not meant to be a trap, but it does require some planning on your part. You can learn more about how this works from the Consumer Financial Protection Bureau’s guide to deferred interest.

The convenience factor is huge too. These healthcare credit cards are accepted at network locations across the country – we’re talking hundreds of thousands of providers. This means once you have the card, you can use it for dental care, vision care, and other medical expenses at participating practices.

“Buy Now, Pay Later” (BNPL) Services

If you’ve ever bought something online and chose to “pay in 4 installments,” you’re already familiar with the concept of Buy Now, Pay Later services. The dental world has acceptd this approach, and it’s been a game-changer for patients who need immediate care but want to split payments into manageable chunks.

What makes BNPL services particularly patient-friendly is their approach to credit checks. Most start with a soft credit check that doesn’t affect your credit score – it’s just to see what options might work for you. Only if you decide to move forward do they typically perform a hard inquiry.

The approval rates are impressive – research shows that up to 87% of patients who apply get approved, which is significantly higher than traditional financing. Some services boast approval rates as high as 99% when you consider all their available options. This means you’re very likely to find a solution that works for your situation.

Payment plans are flexible too. You might choose a short-term option of just 6 weeks (often with 0% APR) for smaller procedures, or extend payments up to 60 months for major work. The key is finding what fits comfortably in your monthly budget.

For dental practices, these services have been transformative. They help increase case acceptance significantly because patients can say “yes” to treatment they might otherwise postpone. If you’re interested in exploring these options, you can learn more about Cherry Payment Plans that we offer.

Traditional Personal Loans

Sometimes the most straightforward approach is the best one. Traditional personal loans work exactly like you’d expect – you borrow a specific amount, get a fixed interest rate, and make the same payment every month until it’s paid off.

What sets personal loans apart is their predictability. You know exactly how much you’ll pay each month and exactly when the loan will be paid off. There are no promotional periods to track or revolving credit limits to manage. You get a fixed loan amount, a set repayment term, and a fixed monthly payment that makes budgeting straightforward.

For extensive dental work, personal loans can be particularly useful because they often allow you to finance larger amounts – up to $75,000 in some cases – with longer repayment terms of up to 144 months. This can make even the most comprehensive treatment plans affordable on a monthly basis.

The trade-off is that personal loans typically involve a hard credit inquiry upfront, and the interest rates depend heavily on your creditworthiness. But if you qualify for a good rate, the simplicity and predictability can be worth it. Comparing interest rates from different lenders is always wise to ensure you’re getting the best deal possible.

What Dental Procedures Can You Finance?

One of the most common questions we hear is, “What kind of dental work can I finance?” The great news is that financing options are incredibly versatile, and dental places that take payments can help you access care for almost any procedure your dentist recommends. Whether you need routine maintenance, urgent treatment, or want to improve your smile, financing makes it all possible without the stress of a large upfront payment.

The beauty of modern dental financing is that it doesn’t discriminate between necessary and elective procedures. Your preventive care like routine cleanings (national average: $203) and exams can be financed just as easily as more complex treatments. This means you never have to skip your regular checkups due to budget constraints.

Restorative dentistry represents a significant portion of financed dental work, and for good reason. When you need a filling (average: $139-$976) or a crown (average: $697-$1,399), waiting isn’t really an option. These procedures restore your teeth’s function and prevent more expensive problems down the road. Bridges, dentures, and inlays can also be financed, ensuring your oral health stays on track.

Cosmetic procedures have become much more accessible thanks to financing options. Veneers, professional teeth whitening, and complete smile makeovers are no longer reserved for special occasions or when you’ve saved enough cash. Many patients find that spreading these costs over time makes their dream smile achievable sooner than they thought possible.

Orthodontic treatment is another area where financing truly shines. With braces averaging $5,108-$9,221 and clear aligners like Invisalign running around $5,108, few families can pay these amounts upfront. Financing transforms these investments into manageable monthly payments, making straight teeth accessible for both teens and adults.

Oral surgery procedures often catch patients off guard with their costs. Dental implants can range from $642 to $12,474, while even simple tooth extractions average $177-$2,685. Having financing options available means you can address these issues promptly rather than delaying treatment and potentially facing complications.

Periodontal and endodontic treatments like root canals (average: $984-$1,337) and deep cleanings for gum disease are essential for maintaining your oral health. These procedures can be uncomfortable enough without adding financial stress to the equation. Financing allows you to focus on healing rather than worrying about the bill.

[LIST] of Financed Dental Services

- Preventive Care – cleanings, exams, X-rays, fluoride treatments, sealants

- Restorative Dentistry – fillings, crowns, bridges, dentures, inlays and onlays

- Cosmetic Procedures – veneers, teeth whitening, smile makeovers

- Orthodontics – braces, clear aligners

- Oral Surgery – implants, extractions, wisdom tooth removal

- Periodontal and Endodontic treatments – root canals, scaling and root planing, gum grafting

The simple truth is this: if your dentist recommends it, there’s almost certainly a way to finance it. You don’t have to choose between your oral health and your budget anymore. Modern financing solutions have made quality dental care accessible to everyone, regardless of their current financial situation.

Frequently Asked Questions About Dental Financing

We understand that dental financing can feel overwhelming when you’re trying to make the best decision for your family’s oral health. Over the years, we’ve heard countless questions from patients who want to understand how dental places that take payments work and what to expect from the financing process. Let’s address the most common concerns we encounter every day.

How does applying for dental financing affect my credit score?

This question comes up in nearly every conversation about dental financing, and for good reason. Your credit score is important, and you want to protect it while getting the care you need.

The good news is that most dental financing starts with a soft credit check, which won’t impact your credit score at all. When you’re exploring options with companies like Cherry or Sunbit, they’ll typically run what’s called a “pre-qualification” check. This gives you a clear picture of your financing options without any risk to your credit.

Here’s what happens if you decide to move forward: Once you accept a financing offer, the lender will perform a hard credit inquiry. This might temporarily lower your credit score by just a few points, but the impact is usually minor and fades quickly.

The best part about dental financing? Making your payments on time can actually improve your credit score over time. Your payment history makes up the largest portion of your credit score calculation, so consistent, on-time payments demonstrate responsible financial behavior that credit agencies love to see.

Opening a new credit line might slightly affect your credit utilization ratio or average account age, but these are typically small, temporary changes. The long-term benefits of getting necessary dental care and building positive payment history usually far outweigh any minor short-term effects.

Can I qualify for financing with less-than-perfect credit?

This is where dental financing really shines compared to traditional lending. The approval rates are remarkably high – our research shows that 99% of patients who apply through third-party lenders get approved for some form of financing. That’s an incredible statistic that reflects how these companies understand healthcare needs.

Even if your credit isn’t perfect, you likely have options. Companies that specialize in healthcare financing look beyond just your credit score. They consider your overall financial picture and understand that medical and dental needs don’t wait for perfect credit timing.

Take Sunbit, for example – they approve 87% of applicants, which is more than double the industry average for traditional lending. These lenders specialize in healthcare financing, so they’re designed to be more inclusive and understanding of the unique circumstances that come with medical expenses.

Don’t let credit concerns keep you from exploring your options. Many of our patients are pleasantly surprised to find they qualify for financing terms they never expected. The worst that can happen is you get a “no,” but with approval rates this high, that’s becoming increasingly rare.

How do I find dental places that take payments?

Finding a dental practice that offers flexible payment options is easier than you might think, and there are several reliable ways to locate dental places that take payments in your area.

Start with your current dentist or a practice you’re considering. Simply call and ask about their payment options. Most modern dental offices, including our practice at Snow Tree Dental, are happy to discuss financing options over the phone. We understand that cost is often a primary concern, and we want to address it upfront.

Check practice websites for financing information. Most dental practices have dedicated sections explaining their payment policies, accepted insurance plans, and financing partnerships. Look for pages labeled “Payment Options,” “Financing,” or “Patient Resources.” These pages often provide detailed information about available plans and approval processes.

Use online provider search tools. Many financing companies offer searchable databases on their websites. You can enter your zip code and find local dental practices that accept their specific financing options. This is particularly helpful if you’re already interested in a particular financing company.

Read patient reviews and experiences. Sometimes patients mention payment flexibility in their online reviews, giving you insight into how accommodating a practice is with financial arrangements.

At Snow Tree Dental, we’ve made it our mission to ensure that financial concerns never stand between you and the dental care you need. We offer transparent pricing, flexible scheduling including evenings and Saturdays, and multiple payment solutions including our own in-house dental plan. If you have questions about what options might work for your situation, please Contact Us to ask about options. We’re always happy to walk you through the possibilities and help you find a solution that fits your budget.

Conclusion

Finding dental places that take payments has never been easier, and we hope this guide has shown you just how many options are available to make dental care fit your budget. The reality is that affordable dental care is absolutely achievable when you know where to look and what questions to ask.

Multiple payment solutions exist to meet you where you are financially. Whether you’re working with dental insurance, considering an in-house discount plan, exploring third-party financing, or looking into buy-now-pay-later services, there’s likely a solution that fits your specific situation. The key is understanding that you don’t have to choose between your oral health and your financial peace of mind.

What excites me most as a dental professional is seeing how these flexible payment options empower patients to say “yes” to treatment they might have otherwise postponed. When someone can spread the cost of a necessary crown over several months, or take advantage of 0% interest financing for a complete smile makeover, it changes everything. You’re no longer stuck watching a small problem become a big, expensive one.

At Snow Tree Dental in Houston, TX, we’ve built our entire practice around making dental care accessible and stress-free. We offer flexible scheduling that works with your life – including evenings and Saturdays, plus same-day emergency appointments when you need them most. Our transparent pricing means no surprises, and our variety of payment solutions, including our in-house plan starting at just $149 per year, ensures we can find something that fits your budget.

Your smile is worth investing in, and with today’s financing options, that investment doesn’t have to break the bank. We’re here to help you steer these choices and find the perfect solution for your family’s dental needs.

Ready to explore what’s possible? Explore Your Finance Options Today and take the first step toward the healthy, confident smile you deserve.