Dental Payment Plans: 7 Flexible Solutions

Why Dental Care Costs Shouldn’t Stop You from Getting Treatment

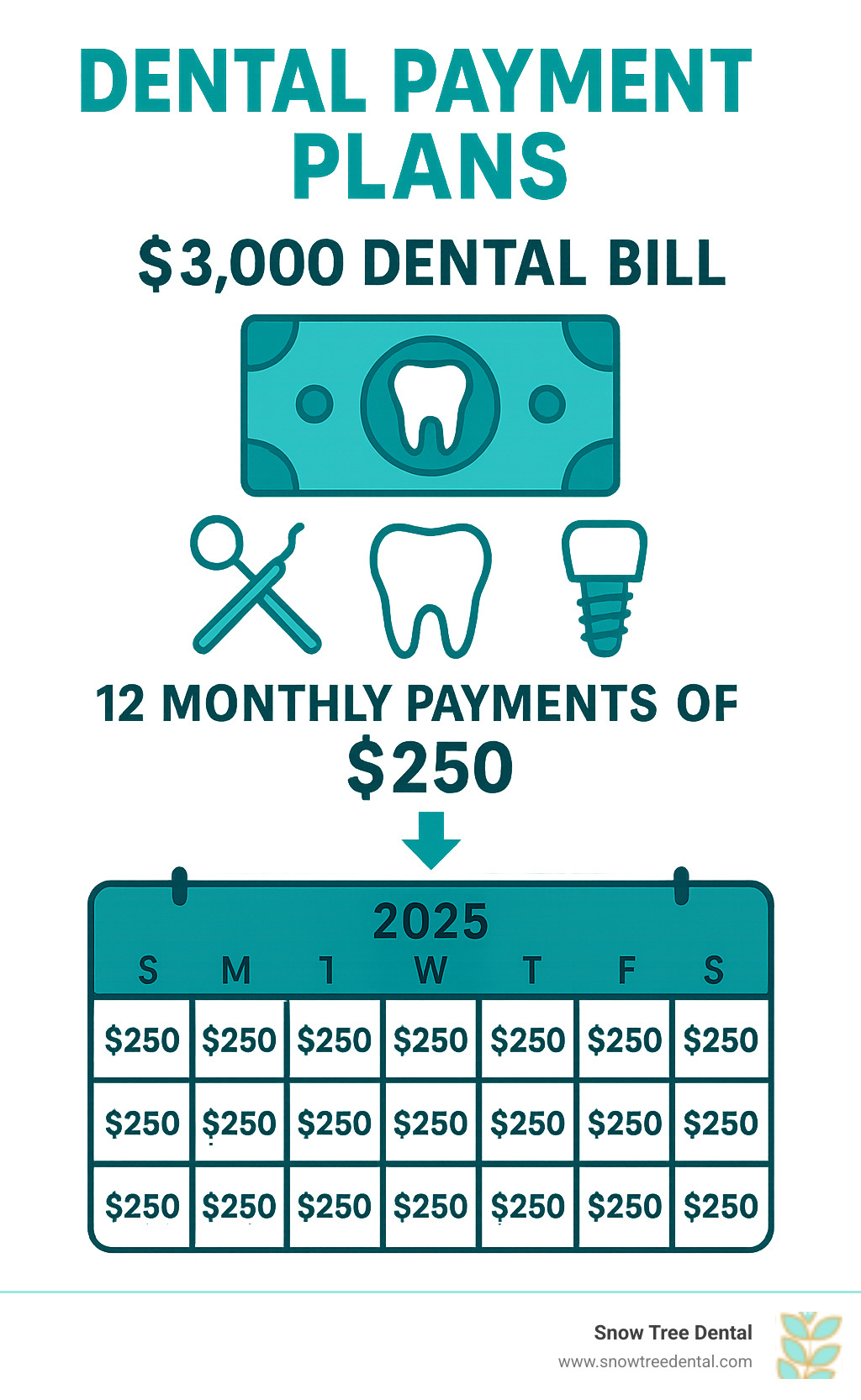

Dental payment plans are financing options that let you break down the cost of dental treatments into smaller, manageable monthly payments instead of paying everything upfront. These plans make dental care accessible by spreading costs over time, often with low or zero interest rates.

Quick Overview of Dental Payment Plans:

- In-house financing: Payment plans offered directly by your dental office

- Third-party financing: Medical credit cards and loans from specialist lenders

- Traditional financing: Personal loans or lines of credit from banks

- Insurance coordination: Plans that work alongside your existing dental coverage

- Flexible terms: Payment periods typically range from 3-84 months

- Credit options: Available for various credit scores, including bad credit

The reality is stark – even routine dental visits can quickly add up, and advanced procedures often come with significant price tags. As one Houston patient shared, “The payment plan allowed me to fix my teeth, without it I wouldn’t have been able to do the orthodontic treatment. I simply didn’t have that kind of money readily available to pay it upfront in one installment.”

Many Canadians face out-of-pocket expenses for dental care despite having private insurance or public benefits. Whether you need emergency treatment, cosmetic work, or major procedures like implants, financing options can bridge the gap between necessary care and your budget.

I’m Dr. Muna Mohammad, a dentist practicing in Houston at Snow Tree Dental, where I’ve helped countless patients steer dental payment plans to access the care they need. Through my experience, I’ve seen how the right financing solution can transform a patient’s ability to maintain their oral health without financial stress.

What Are Dental Payment Plans and How Do They Work?

Think of dental payment plans as your financial bridge to better oral health. Instead of facing a large dental bill all at once, these financing options let you break down treatment costs into smaller, more manageable monthly payments. It’s like turning a mountain into a series of manageable hills you can climb one step at a time.

The beauty of dental financing lies in its simplicity. You receive the treatment you need today, and then pay for it over time through a structured payment schedule. This approach means you don’t have to delay important dental care while saving up for the full amount.

At Snow Tree Dental, we’ve seen how dental payment plans can transform a patient’s relationship with their oral health. No more putting off that root canal or delaying cosmetic work because of upfront costs. The application process is typically straightforward, and we’re here to help guide you through your options every step of the way.

Whether you’re dealing with an unexpected dental emergency or planning a smile makeover, financing opens doors that might otherwise remain closed. For complete details about what we offer, check out our Finance Options page.

In-House Financing

In-house financing is like working directly with a trusted friend – it’s personal, convenient, and designed with your specific needs in mind. When you choose this option, you’re making payment arrangements directly with our dental office, cutting out the middleman entirely.

One of the biggest advantages is the potential for 0% interest arrangements, especially for shorter payment terms. We understand that every patient’s financial situation is unique, so we work with you to create a payment schedule that actually fits your budget.

Typically, you’ll make a down payment on the day of your treatment, then spread the remaining balance over a shorter timeframe – usually between 3 to 6 months. This keeps things simple and manageable while ensuring you get the care you need without delay.

The convenience factor can’t be overstated. There’s less paperwork, no waiting for third-party approvals, and you’re dealing directly with people who already know you and your treatment plan.

Third-Party Financing

Sometimes your financing needs require a different approach, and that’s where third-party financing comes in. These are specialist medical lenders who focus specifically on healthcare procedures, including dental work.

The main advantage here is flexibility – these lenders often offer longer payment terms (sometimes 12 to 84 months) and can handle higher financing amounts than typical in-house plans. If you’re looking at extensive treatment or major procedures, this might be the route that works best for your situation.

The process does involve credit approval, but many of these specialized lenders are designed to be more accessible than traditional bank loans. They understand that dental care is essential, not optional, and their approval criteria often reflect that understanding.

While the terms can be longer and the amounts higher, it’s important to carefully review interest rates and payment terms. Each lender has different requirements and offers, so it’s worth exploring what’s available. You can learn more about various dental financing options through resources like this comprehensive guide that breaks down different approaches to dental financing.

Key Dental Financing Options to Consider

When you’re facing a dental bill that makes your wallet feel a little lighter, you’re not stuck with just two choices: pay everything upfront or put it on a high-interest credit card. The good news is that dental payment plans come in many forms, each designed to make your treatment more affordable.

Your main options include personal loans from banks, lines of credit that give you ongoing access to funds, and medical credit cards specifically designed for healthcare expenses. Each path has its own personality – some are more flexible, others offer lower interest rates, and some are easier to qualify for even if your credit isn’t perfect.

Traditional Lenders vs. Specialist Lenders

Think of financing options like choosing between a general store and a specialty shop. Both can meet your needs, but they offer very different experiences.

Traditional lenders like banks and credit unions are the general stores of the financing world. They offer personal loans and lines of credit that can certainly cover your dental work. If you have excellent credit, you might snag a competitive interest rate. The application process tends to be thorough – expect a detailed credit check and possibly a longer wait for approval. These loans work for any expense, which means they’re not custom specifically for medical situations. You can learn more about these general financing options from Loans and Lines of Credit – Government of Canada.

Specialist lenders are like that perfect specialty shop that has exactly what you need. These companies focus exclusively on healthcare financing and understand the unique challenges patients face. They often offer promotional periods with 0% interest, faster approval processes, and more flexible credit requirements. Some even work with patients who have less-than-perfect credit, though usually at higher interest rates.

The trade-off? Once promotional periods end, interest rates might climb higher than traditional loans. But for many patients, the specialized approach and faster access to treatment make specialist lenders an attractive choice.

The Role of Dental Insurance

Your dental insurance is like having a reliable friend who helps split the bill – it’s your first line of defense against high dental costs. Most insurance plans shine when it comes to preventative care, often covering cleanings and check-ups at 100%. Even for more complex procedures, insurance can significantly reduce your out-of-pocket costs.

But here’s where it gets tricky. Every insurance plan comes with its own rulebook. You’ll encounter co-pays (your fixed portion for each service), deductibles (what you pay before insurance kicks in), and annual maximums (the total amount your plan will cover each year). These limits mean that even with great insurance, you might still need financing for major procedures.

We work with many insurance providers and love helping patients understand their benefits – no insurance-speak, just plain English explanations. Check out our Insurance Information page to see how we can help maximize your coverage.

PPO vs. HMO Dental Insurance Plans

Choosing between PPO and HMO dental plans is like deciding between a buffet and a set menu – both feed you, but the experience is completely different.

| Feature | PPO Plans | HMO Plans |

|---|---|---|

| Network Flexibility | Large network, can go out-of-network (higher cost) | Must stay within network, choose primary dentist |

| Cost | Higher premiums, deductibles, co-pays | Lower premiums, often no deductibles |

| Referral Requirements | See specialists directly, no referral needed | Need referral from primary dentist for specialists |

PPO plans give you the freedom to choose your dentist and see specialists without jumping through referral hoops. You’ll pay more in premiums, but you get flexibility and choice. If you travel frequently or have a dentist you love who might not be in every network, PPO plans often make sense.

HMO plans keep costs lower by working within a tighter network. Your premiums are typically lower, and preventative care often costs you nothing. The catch? You’ll need to stay within the network and get referrals for specialist care.

The best choice depends on your budget, how much flexibility you want, and whether you already have a dentist you’d like to keep seeing.

What Dental Services Can Be Financed?

One of the most reassuring aspects of dental payment plans is how comprehensive they are. Whether you’re dealing with a sudden toothache or planning to transform your smile, financing options can cover virtually any dental treatment you might need. This flexibility means you never have to choose between your oral health and your budget.

The range of procedures that can be financed is truly impressive. From your six-month cleaning to complex full-mouth reconstructions, most dental financing providers understand that oral health comes in many forms. This broad coverage ensures that whether you’re addressing urgent medical needs or pursuing cosmetic improvements, financial barriers don’t have to stand in your way.

General and Preventative Dentistry

Sometimes even the basics can feel overwhelming when costs add up, especially for families with multiple members needing care. Dental payment plans make it easier to stay on top of essential treatments like regular check-ups and professional cleanings. These routine visits are your best defense against bigger, more expensive problems down the road.

When issues do arise, financing can cover necessary treatments like fillings, root canals, and other restorative work. A root canal might cost several hundred dollars, but spreading that cost over several months can make the difference between getting treatment now or waiting until the problem gets worse (and more expensive).

At Snow Tree Dental, we believe preventative care should never be delayed due to cost concerns. Our financing options ensure that you can maintain consistent oral health without breaking the bank. You can explore all our preventative services at Our General Dentistry services.

Cosmetic and Major Procedures

This is where dental financing really shows its value. Major procedures that can dramatically improve your quality of life become accessible when you can spread the costs over time. Dental implants, which can range from $4,000 to $7,000 per tooth, suddenly become manageable when broken into monthly payments.

Orthodontic treatments like braces or Invisalign, typically costing between $3,000 and $10,000, are among the most commonly financed procedures. These treatments often take months or years to complete, making payment plans a natural fit. Other popular financed procedures include veneers, crowns, and dentures – all investments that can transform both your smile and your confidence.

The beauty of financing these procedures is that you can start treatment immediately rather than saving up for months or years. Your smile change can begin today. Learn more about our cosmetic options at Our Cosmetic Dentistry services.

Emergency Dental Care

Dental emergencies never come at a convenient time, and they certainly don’t wait for your next paycheck. When you’re dealing with severe tooth pain, a broken tooth, or an infected wisdom tooth, immediate treatment isn’t just about comfort – it’s about preventing serious complications.

Emergency procedures like root canals (often $500 or more) or wisdom tooth removal (ranging from $150 to $850 per tooth) can create unexpected financial stress just when you’re already dealing with pain and worry. Dental payment plans remove this additional burden, allowing you to focus on healing rather than finances.

At Snow Tree Dental, we understand that dental emergencies can’t wait. Our financing options ensure that when you need immediate care, cost won’t delay your treatment. No one should have to endure dental pain because they’re worried about the bill.

How to Choose and Qualify for the Right Plan

Selecting the right dental payment plan doesn’t have to feel overwhelming. Think of it like choosing a monthly phone plan – you want something that fits your budget and gives you what you need without any nasty surprises.

Start by taking an honest look at your monthly budget. How much can you comfortably set aside for dental payments without stretching yourself too thin? This is about improving your health and quality of life, not creating financial stress.

Next, compare the interest rates and terms from different providers. Some plans offer 0% interest for shorter periods, while others might have low interest rates spread over longer terms. The key is finding the sweet spot between a monthly payment you can handle and total interest costs that make sense.

Here’s where many people trip up – always read the fine print. Look for details about late payment fees, early payoff penalties, and what happens if you miss a payment. If something isn’t clear, ask questions. A reputable provider will be happy to explain everything in plain English.

Can You Get Dental Financing with Bad Credit?

The short answer is yes, and we see it happen all the time. Having less-than-perfect credit doesn’t automatically shut the door on dental payment plans.

Many specialist medical lenders understand that dental emergencies don’t wait for your credit score to improve. While traditional banks might turn you away, companies that focus on healthcare financing are often more flexible. They look at factors beyond just your credit score, like your current income and employment stability.

You’ll likely face higher interest rates with bad credit – that’s just the reality. But consider this: delaying necessary dental treatment often leads to bigger, more expensive problems down the road. A small filling today is much more affordable than a root canal and crown later.

Many providers use soft credit pulls for initial applications, which won’t hurt your credit score. This means you can explore your options without worry. Some lenders have approved patients with credit scores as low as 600, though your chances improve significantly with scores above 623.

Secured loans might be another option if you have collateral to offer. These typically come with lower interest rates since the lender has less risk.

Are There No-Interest Dental Payment Plans?

Absolutely! Zero-interest dental payment plans are often the holy grail of dental financing, and they’re more common than you might think.

Many dental offices, including ours at Snow Tree Dental, offer in-house financing with 0% interest for shorter payment periods. This is often the most straightforward option since you’re working directly with your dental team.

Some third-party lenders also offer promotional periods with 0% APR, typically lasting anywhere from 3 to 24 months. These can be fantastic deals if you can pay off the balance within the promotional period.

But here’s where you need to be careful – watch out for deferred interest traps. Some 0% offers aren’t truly interest-free. If you don’t pay off the entire balance before the promotional period ends, they can charge you interest on the original amount from day one. It’s like they were keeping a running tab the whole time.

Always ask whether it’s “no interest” or “deferred interest.” True no-interest plans won’t charge you anything extra as long as you make your payments on time.

How to Find Clinics That Offer Dental Payment Plans

Finding a dental practice that offers flexible dental payment plans is easier than you might expect, especially as more offices recognize the importance of making care accessible.

Start with a simple online search for dental offices in your area, then visit their websites. Most practices that offer financing options will highlight this prominently – it’s a major selling point. Look for phrases like “flexible payment options,” “financing available,” or “payment plans offered.”

Don’t be shy about calling offices directly. When you call, simply ask: “Do you offer payment plans or financing options for dental work?” Most front desk staff can quickly tell you about in-house plans and any third-party lenders they work with.

Check patient reviews and testimonials on Google, Yelp, or the practice’s website. Patients often mention positive experiences with payment plans in their reviews, which can give you insight into how flexible and helpful a practice really is.

At Snow Tree Dental, we’re proud to offer multiple financing solutions because we believe everyone deserves access to quality dental care, regardless of their financial situation. We’ve seen too many patients delay necessary treatment due to cost concerns, and we’re committed to removing those barriers whenever possible.

Frequently Asked Questions about Dental Payment Plans

We get it – thinking about dental costs can feel overwhelming. That’s why we’ve gathered the most common questions our Houston patients ask about dental payment plans. These answers should help you feel more confident about making your dental care affordable.

What is the typical cost of common dental procedures?

Let’s be honest – dental work isn’t cheap, but knowing what to expect can help you plan better. While costs vary based on your location and the complexity of your treatment, here’s what you can generally expect to pay:

Routine care like dental cleanings and exams typically run $150 to $300. Simple fillings usually cost $150 to $400 per tooth, depending on the material used and the size of the cavity.

When you need more involved treatment, costs go up significantly. Root canal treatment ranges from $500 to $1,500 or more, while dental implants – which include the post, abutment, and crown – can cost $3,000 to $7,000 per implant.

For orthodontic treatment, both traditional braces and Invisalign typically range from $3,000 to $10,000. Wisdom tooth removal varies widely based on complexity, usually running $150 to $850 per tooth.

These numbers show exactly why dental payment plans make such a difference. Instead of paying thousands upfront, you can break these costs into payments that fit your monthly budget.

What do I need to apply for financing?

The good news is that applying for dental financing is usually straightforward. Most lenders – whether it’s our in-house plan or a third-party provider – will ask for similar information.

You’ll need valid identification like your driver’s license or passport. Proof of income is also required, which could be recent pay stubs, tax returns, or bank statements. This helps lenders understand your ability to make monthly payments.

Most third-party lenders will run a credit check, though many specialized medical lenders use soft credit pulls that won’t hurt your credit score during the initial application. You’ll also need your bank account details for setting up automatic payments.

The basic requirement is being over 18 years old. Our team at Snow Tree Dental is always here to walk you through the application process for our in-house plans or help you understand what external financing options might need.

Can I use a payment plan if I have dental insurance?

Absolutely – and this is actually one of the smartest ways to manage dental costs! Your dental insurance is fantastic, but it rarely covers everything. You’ll often have deductibles to meet, co-pays for certain services, or procedures that are only partially covered.

Dental payment plans work perfectly alongside your insurance to cover what’s left over. Let’s say your insurance covers 80% of a crown – you can finance that remaining 20% instead of paying it all at once. This is especially helpful for cosmetic procedures, which many insurance plans don’t cover at all.

We see this combination work beautifully for our patients all the time. You get to maximize your insurance benefits while still accessing the full scope of care you need. It’s like having the best of both worlds – insurance coverage plus flexible payment options for everything else.

Take Control of Your Oral Health Today

Your smile is worth investing in, and dental payment plans are here to make that investment possible. These financing options transform what might seem like an overwhelming expense into something completely manageable – just smaller monthly payments that fit comfortably into your budget.

The beauty of dental financing is that it lets you say “yes” to the care you need right now, instead of “maybe later” when finances improve. We’ve seen too many patients wait on necessary treatments, only to have small problems turn into bigger, more expensive ones. That’s exactly what we want to help you avoid.

Whether you’re looking at routine cleanings and check-ups, cosmetic improvements like teeth whitening or veneers, or major restorative work such as dental implants, there’s likely a payment option that works for your situation. The key is not letting cost be the deciding factor in your oral health decisions.

At Snow Tree Dental here in Houston, we’ve built our practice around making quality dental care both accessible and convenient for our community. We combine the latest dental technology to keep your visits comfortable and efficient, with flexible scheduling that includes evenings and Saturdays. Our transparent pricing means no surprise bills, and our in-house dental plan gives you another layer of affordability.

We genuinely believe that financial stress shouldn’t be part of your dental experience. That’s why we work so hard to offer multiple payment solutions and help you find the one that fits best. Your optimal oral health is within reach – and it doesn’t have to wait.

Ready to explore your options? Explore our comprehensive dental services and find how we can help you achieve the healthy, confident smile you deserve.