Dental care with payment plans near me 2025: No Stress!

Why Dental Payment Plans Are Your Key to Affordable Care

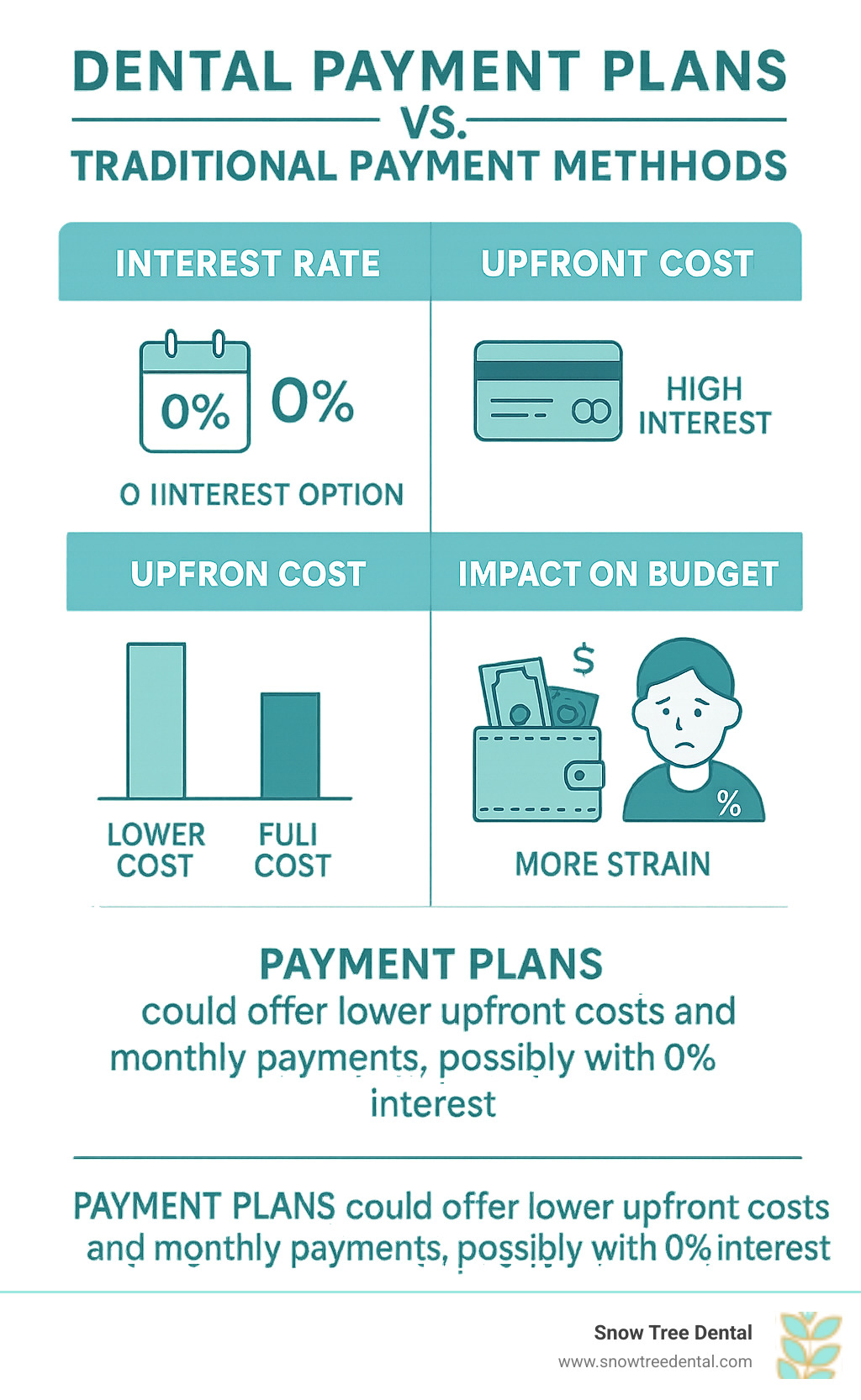

Searching for dental care with payment plans near me is common because delaying treatment due to cost is a major concern. Whether you need a routine cleaning or dental implants, payment plans can transform a large dental bill into manageable monthly installments. For example, a $3,000 procedure could become just $125 a month over 24 months.

Quick Answer: Finding Dental Care with Payment Plans

- Search online for “dentist payment plans Houston” or check financing directories like Cherry Payment Plans

- Call dental offices directly – most practices offer either in-house plans or third-party financing

- Popular options include: 0% interest plans, third-party financing (Beautifi, LendCare), and in-house payment plans

- Typical terms: 3-60 months repayment, loans up to $15,000, interest rates starting at 0-9.9% APR

- Application time: Less than 3 minutes with instant approval for most plans

The reality is that dental problems don’t wait for your budget. As one patient shared, “Most of us have many financial obligations that can fortunately be paid on a monthly basis”—and now dental care can work the same way. Payment plans remove the financial barrier, allowing you to address painful issues or get the cosmetic work you’ve been wanting.

Most treatments over $500 qualify for financing, from general dentistry to cosmetic procedures. At Snow Tree Dental, Dr. Muna Mohammad helps Houston families access care with flexible financing. We’ve seen that when patients can spread out costs, they’re more likely to get the preventive care that keeps their smiles healthy for life.

The Benefits of Choosing a Dental Payment Plan

Searches for dental care with payment plans near me are popular because high upfront costs cause many people to delay important treatments. However, dental problems don’t pause while you save. A small cavity can become a painful root canal, and nagging tooth pain rarely disappears on its own. Payment plans solve this by allowing you to get treatment now and spread the cost into budget-friendly monthly installments.

This approach transforms dental care from a potential budget crisis into a manageable monthly expense, reducing financial stress and providing peace of mind. At Snow Tree Dental, we’ve seen how patients who can access care without draining their savings are happier, healthier, and more likely to keep up with preventive treatments. Our cosmetic dentistry services become far more accessible when not limited by upfront costs.

Why Payment Plans Make Expensive Procedures Accessible

Procedures like smile makeovers, dental implants, or Invisalign can seem out of reach with price tags in the thousands. Payment plans change this by breaking down large costs. A $3,000 Invisalign treatment could become around $125 a month, and the veneers you’ve been dreaming of can be as affordable as a monthly subscription.

By spreading costs over time, a single dental implant or a full smile makeover becomes achievable. As one patient said, getting veneers with a payment plan was “like getting a new smile on layaway, except I got to wear it right away.” You get immediate results while paying at a comfortable pace.

Moving Forward with Treatment Without Delay

Payment plans enable preventative care over crisis management. Addressing small problems early is far better and cheaper than waiting for them to become expensive emergencies. When you can afford regular care, you can maintain your oral health and avoid complex procedures down the road.

Immediate treatment access keeps you out of pain and helps you avoid stressful weekend dental emergencies. Since poor oral health is linked to serious conditions like heart disease and diabetes, payment plans are an investment in your long-term health and wellbeing.

How Dental Financing Works: From Application to Treatment

Getting dental financing is simpler than most people imagine. The process is designed to be quick and stress-free. When searching for dental care with payment plans near me, you’ll find two main types: in-house financing from the dental office and third-party financing from specialized lenders. Both aim to make dental care affordable.

At Snow Tree Dental, we offer flexible in-house financing for our Houston families and partner with trusted third-party companies. These partnerships can provide loan limits up to $15,000 with repayment periods as long as 60 months. Most applications are completed online in minutes with instant approval decisions, so you can know your payment options before your appointment begins. To see a specific example, you can learn about our Cherry Payment Plans.

The Simple Application Process

Applying for dental financing is user-friendly and fast. Most applications take less than 3 minutes and require only basic information, like a government-issued ID and financial details. Many providers use soft credit checks for pre-approval, so you can explore your options without impacting your credit score. The process involves minimal paperwork, allowing for quick and painless approvals.

What Dental Services Are Covered?

Payment plans are comprehensive, covering nearly any dental treatment. This includes:

- General dentistry: Fillings, crowns, cleanings, and check-ups.

- Cosmetic procedures: Teeth whitening, veneers, and smile makeovers.

- Orthodontic treatments: Braces and Invisalign.

- Major procedures: Dental implants, bridges, dentures, and full mouth reconstructions.

Typically, any significant dental work over a minimum cost (e.g., $500) will qualify for financing.

In-House Plans vs. Third-Party Financing

Choosing between in-house and third-party financing depends on your needs.

- In-house plans, like those at Snow Tree Dental, offer a direct, personal relationship and unique flexibility.

- Third-party lenders often provide higher loan limits, longer repayment terms, and various interest rate options, including 0% APR for qualified applicants. They handle the loan administration, allowing our team to focus on your care.

The growing availability of financing, and even government programs like Canada’s dental care plan, shows a commitment to making dental health accessible. The goal is to find the option that fits your financial situation, so you can get the care you need without stress.

Navigating the Financials of Your Payment Plan

Once you’ve found dental care with payment plans near me, understanding the financial details is key. We believe in transparency, so you can make a confident choice.

Many patients are excited to find 0% interest financing, which lets you pay for treatment over time with no extra cost. Other plans may have low interest rates, some starting at 9.9% APR. Understanding the Annual Percentage Rate (APR) helps you see the true cost of borrowing. Plans also offer flexible repayment terms, from short 3-month plans to longer 60-month options for the lowest possible monthly payment.

Most reputable plans have no prepayment penalties, so you can pay off your balance early without a fee. Regarding your credit, most applications start with a soft credit check that doesn’t affect your score. If you accept a plan, a hard inquiry may occur, but making on-time payments can help improve your credit over time.

For more ways to save, explore our in-house Dental Plan, which offers added flexibility for our Houston families.

Finding Interest-Free and Low-Interest Options

Interest-free options are more common than you might think. Many lenders offer promotional 0% APR periods (e.g., 6 or 12 months) where you pay no interest if the balance is paid in full within that time. Some plans even offer 4 interest-free payments. Always read the terms to understand what happens if the balance isn’t paid off during the promotional period. Comparing interest rates between providers is also smart, as a few percentage points can make a big difference.

Understanding Repayment Terms and Your Credit Score

Choosing a repayment term is about balancing your monthly budget. Short-term plans (3-24 months) have higher payments but lower overall cost. Longer-term options (up to 60 months) offer lower monthly payments but may accrue more interest. A longer plan can feel like a manageable monthly subscription to your dental health.

Most financing begins with a soft credit check to pre-qualify you without affecting your credit report. If you proceed, a hard inquiry might temporarily lower your score by a few points. However, making on-time payments demonstrates financial responsibility and can help build your credit score over time.

Your Guide to Finding Dental Care with Payment Plans Near Me

Finding dental care with payment plans near me is easier than ever, as many dental practices in Houston and beyond are transparent about their financing options. They want to help you get the care you need.

Start with a specific online search like “dentist financing options Houston.” Look for a “Payment Options” or “Financial” page on a dentist’s website. Many third-party financing companies also have online directories to help you find participating practices. At Snow Tree Dental, we make our financing options easy to find because we believe cost shouldn’t be a barrier to quality care.

How to Search for Local Dentists Offering Payment Plans

- Use specific search terms: Try “dental payment plans Houston” or “0% interest dental financing” to find practices that highlight these options.

- Check their websites: Look for a dedicated page explaining their in-house plans and third-party financing partnerships.

- Call the office directly: If you can’t find information online, call and ask about their payment plans, eligibility, and application process. Our team at Snow Tree Dental is always happy to help.

- Use financing company directories: Many lenders have search tools on their websites to find local dental practices that accept their plans.

Combining Payment Plans with Your Dental Insurance

You can use dental insurance and a payment plan together to make care even more affordable. Payment plans are perfect for covering out-of-pocket costs that insurance doesn’t, such as:

- Deductibles and co-payments

- Cosmetic procedures not covered by your plan

- Treatments that exceed your annual maximum

This ensures you don’t have to delay important care. We work with many insurance providers to maximize your benefits first, then use a payment plan for the rest. For details, see our Insurance Information page.

Questions to Ask About Your Dental Care with Payment Plans Near Me

When discussing payment plans, ask the right questions to feel confident in your decision:

- What are the exact interest rates and fees? Are there 0% interest promotions?

- What repayment terms are available (e.g., 12, 24, 60 months), and what would my monthly payment be?

- Is there a penalty for paying the plan off early?

- What is the application process like, and will it affect my credit score?

- Who do I contact for support—the dental office or the financing company?

Our team is always ready to answer these questions and help you find the best solution.

Frequently Asked Questions about Dental Financing

Exploring financing can bring up questions. Here are answers to the most common ones we hear from Houston families looking for dental care with payment plans near me.

What if I have bad credit? Can I still get financing?

Yes, it’s often possible. Having less-than-perfect credit doesn’t automatically disqualify you from dental financing. Many of our financing partners work with a wide range of credit scores. While your credit history may influence the interest rate or loan amount you’re offered, options are typically available. Most initial applications use a “soft credit inquiry,” which doesn’t affect your credit score, so it’s always worth applying to see what you qualify for.

Can I pay off my dental payment plan early?

Absolutely. Most reputable financing options, including our in-house and third-party plans, have no prepayment penalties. This gives you the flexibility to pay off your balance early, which can save you money on interest charges and give you peace of mind.

What information do I need to apply for a dental payment plan?

The application process is simple and fast, often taking less than three minutes to complete online. You will typically need just three things:

- A government-issued ID (e.g., driver’s license)

- Your Social Security number

- Basic income and employment details

With instant approval decisions, this streamlined process ensures that financing doesn’t become another barrier to getting the care you need.

Conclusion

Your smile shouldn’t have to wait. The search for dental care with payment plans near me has empowered Houston families to overcome financial barriers and prioritize their oral health. Payment plans make essential and cosmetic dental care affordable by turning large costs into manageable monthly payments.

Whether you need to address a painful toothache, invest in preventative care, or finally get the smile makeover you’ve been dreaming of, financing makes it possible to start today. Don’t let cost concerns keep you from the confidence and well-being that come with a healthy smile.

At Snow Tree Dental, we believe quality dental care should be accessible to everyone. That’s why we offer comprehensive Finance Options, including flexible payment plans and our own in-house dental plan. We combine transparent pricing and modern technology with convenient scheduling—including evenings, Saturdays, and same-day emergency appointments—to fit your life.

Take the first step toward the healthy, confident smile you deserve. Reach out to our team today to discuss your options. Your future self will thank you.