Dental places that do payment plans: Your #1 Easy Guide

Why Dental Payment Plans Make Quality Care Accessible

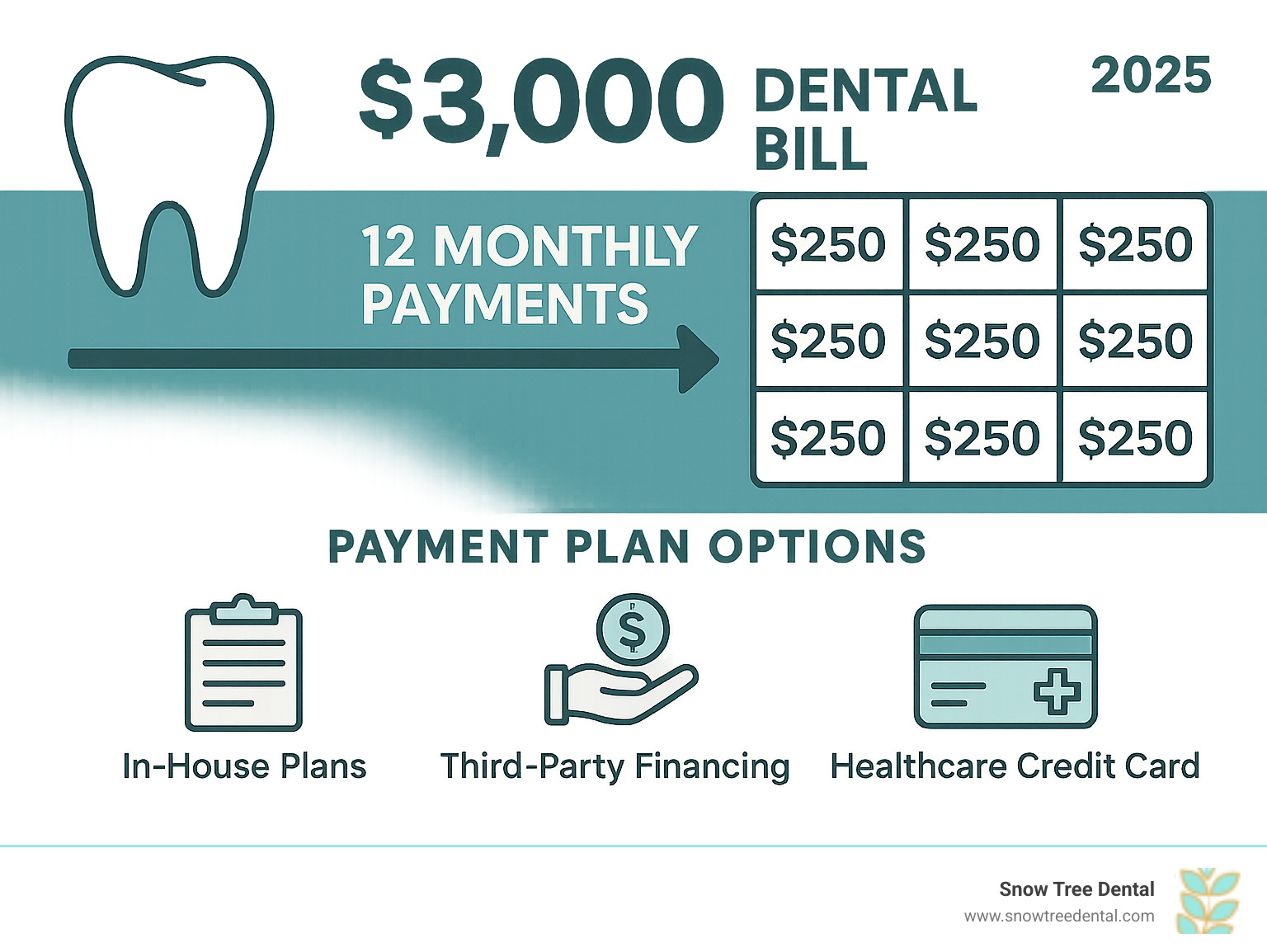

Dental places that do payment plans are becoming essential for families facing the reality that quality dental care can cost thousands of dollars. With routine cleanings averaging $150-$300 and major procedures like dental implants ranging from $3,000-$6,000, many people delay or skip necessary treatments due to cost concerns.

Top dental places offering payment plans include:

- In-house financing – Direct payment arrangements with your dental office

- Third-party lenders – Companies like CareCredit, Cherry, and Compassionate Finance

- Healthcare credit cards – Specialized cards for medical expenses

- Flexible monthly plans – Options starting as low as $40/month

The good news? 99% of patients are approved for some form of dental financing when applying through trusted lenders. These payment plans let you break up treatment costs into manageable monthly payments, so you can get the care you need right away without paying everything upfront.

As Dr. Muna Mohammad, a practicing dentist in Houston at Snow Tree Dental, I’ve seen how payment plans transform patients’ access to care. My experience helping families steer dental places that do payment plans has shown me that the right financing option can make the difference between delaying treatment and maintaining optimal oral health.

Why Consider a Dental Payment Plan?

Let’s be honest – nobody enjoys getting hit with a big dental bill. That sticker shock is exactly why so many people keep putting off the dental work they need. But here’s the thing: waiting often makes problems worse and more expensive to fix later.

Dental places that do payment plans change this entire equation. Instead of watching a small cavity turn into a root canal because you can’t afford treatment today, payment plans let you get the care you need right now.

Immediate access to care is the biggest game-changer. No more lying awake at night with a toothache, telling yourself you’ll deal with it “when you can afford it.” With a payment plan, you can walk into the dentist’s office tomorrow and start treatment, even if you don’t have thousands sitting in your checking account.

The beauty of budget-friendly monthly payments is how they fit into real life. Instead of scrambling to find $4,000 for Invisalign all at once, you might pay $150 a month. That’s often less than what people spend on coffee and lunch out – and infinitely more important for your health and confidence.

This financial flexibility means you’re not choosing between fixing your teeth and paying your mortgage. You can prioritize your oral health without turning your budget upside down. We’ve watched patients light up when they realize they can finally get that smile they’ve been dreaming about.

Payment plans work for almost everything dental. Dental implants that typically run $3,000-$6,000 per tooth become manageable. Braces and Invisalign treatments ranging from $4,000-$10,000 suddenly feel doable. Even everyday needs like root canals ($600-$1,500), crowns ($700-$1,400), and cosmetic dentistry can be broken into bite-sized payments.

The best part? You’re covered whether it’s planned or unexpected. That emergency wisdom tooth removal or sudden need for a crown doesn’t have to derail your finances.

At Snow Tree Dental, we believe everyone deserves access to quality care, which is why we offer flexible financing options. More info about our in-house dental plan can help you see exactly how affordable great dental care can be.

How to Find Dental Places That Do Payment Plans

Finding dental places that do payment plans doesn’t have to feel like searching for a needle in a haystack. The truth is, many dental practices today recognize that quality care shouldn’t be out of reach because of cost, and they’ve adapted to help patients like you.

Start with your current dentist – it’s often the easiest place to begin. You might be surprised to learn that your dental office already offers financing options you didn’t know about. Many practices, including ours at Snow Tree Dental, provide both in-house payment plans and partnerships with trusted financing companies.

When you call or visit, ask to speak with the office manager or patient care coordinator. These team members are your best resource for understanding what’s available. They can explain everything from zero-interest promotions to flexible monthly payment options. Don’t feel embarrassed about asking – we have these conversations every day, and we’re genuinely happy to help you find a solution that works.

If you’re looking for a new dental provider, your online search strategy matters. Try searching for terms like “dental places that do payment plans near me” or “dentist with payment plans Houston TX.” You can also search for “dental financing options” or “0% interest dental plans” to find practices that specifically advertise these services.

Check provider networks through financing company websites. Many third-party lenders have search tools that show you which dental offices in your area accept their payment plans. This can save you time by narrowing down your options to practices that definitely offer the financing you’re looking for.

Patient reviews can be goldmines of information too. While most reviews focus on the quality of care, some patients mention their positive experiences with a practice’s payment flexibility or how helpful the staff was in explaining financial options. These real-world insights can tell you a lot about how a dental office approaches patient care beyond just the clinical side.

At Snow Tree Dental, we believe that cost should never be a barrier to getting the dental care you need. We’re always transparent about pricing and committed to finding payment solutions that fit your budget. Contact Us to ask about our options – we’d love to help you explore what’s possible for your smile and your wallet.

Understanding Your Options: In-House vs. Third-Party Financing

When you’re looking at dental places that do payment plans, you’ll find there are really two main paths you can take. Think of it like choosing between shopping at a small local store versus a big chain – both get you what you need, but the experience is different.

In-house plans are like having a friendly conversation with your dental team about what works for your budget. These are payment arrangements we make directly with you, right here in our office. We sit down together and figure out a plan that makes sense for your specific treatment and financial situation.

The beauty of in-house plans is their personal touch. Maybe you need a root canal and crown, and we work out a down payment followed by monthly payments that fit your budget. We know you, we’ve built a relationship, and we can often be more flexible with the terms. Some dental offices don’t require a credit check at all, or if they do, it’s usually much more relaxed than what you’d face elsewhere.

Third-party financing options work differently – they’re provided by companies that specialize in healthcare financing, but you can access them right through your dental office. It’s like having a financing expert available without leaving the building.

These external companies offer some pretty attractive deals. Many provide healthcare credit cards specifically designed for medical expenses. The real standout feature? Zero-interest promotions that can save you serious money. Some companies let you split payments into 4 interest-free installments, while others offer monthly payments with 0% APR for 3, 6, 12, 18, or even 24 months.

The catch is understanding the fine print. These promotional rates are fantastic if you can pay within the specified time frame. Miss that deadline, and you might face higher interest rates. But when used correctly, they’re an excellent way to get the care you need without paying extra.

Here’s how these options stack up against each other:

| Feature | In-House Plans | Third-Party Financing |

|---|---|---|

| Interest Rates | Often 0% or low interest, varies by practice | Can be 0% APR (promotional) or standard APR (e.g., 21%+) |

| Application | Direct with dental office, potentially simpler | Online application, often quick approval |

| Credit Check | May be less stringent or not required | Typically involves a credit check (soft or hard) |

| Flexibility | Highly customizable terms | Set terms (e.g., 3, 6, 12 months), but varied options |

| Scope | Specific to treatment at that dental practice | Usable at any participating healthcare provider |

One major advantage of third-party financing is that once you’re approved, you can use it at any participating healthcare provider. So if you need dental work, vision care, or even veterinary services, you’re covered.

At Snow Tree Dental, we believe in giving you choices that actually work for your life. We’re committed to transparent pricing and making sure you understand every detail of your payment plan before moving forward. Learn more about our payment plan options.

What to Look For and What to Avoid

When exploring dental places that do payment plans, it’s easy to get excited about the prospect of affordable monthly payments. But hold on – let’s make sure you’re getting the best deal possible! Think of this as your friendly guide to avoiding financial surprises down the road.

Interest rates should be your first stop when comparing options. Here’s where things can get tricky: not all “0% interest” deals are created equal. Some offers are genuinely interest-free, while others use something called deferred interest.

Let me explain deferred interest in simple terms. Imagine you sign up for a 12-month 0% plan for a $2,400 treatment. If you pay it off completely within those 12 months, you truly pay zero interest. But if even $1 remains after 12 months, you could suddenly owe interest on the entire $2,400 – calculated from day one! That’s a costly surprise nobody wants.

Always ask your dental office: “Is this truly 0% interest, or deferred interest?” It’s a question that could save you hundreds of dollars.

Next, let’s talk about eligibility requirements. Your credit score plays a big role here. While some financing companies approve patients with credit scores as low as 600, others prefer scores of 670 or higher. The good news? Many providers have high approval rates – some even reaching 99% approval.

Most applications involve a credit check, but there are two types. A “soft” inquiry won’t affect your credit score and is often used for pre-qualification. A “hard” inquiry can temporarily lower your score but is usually needed for final approval. Don’t be afraid to ask which type they’ll use.

Repayment terms deserve careful attention too. Make sure your monthly payment fits comfortably in your budget. Common terms range from 3 to 24 months, and longer terms mean smaller monthly payments but potentially more interest over time.

Watch out for late fees – they can add up quickly and hurt your credit score. On the flip side, look for plans that don’t charge prepayment penalties. This flexibility lets you pay off your balance early if you come into some extra money.

Here’s something really important: you have every right to understand exactly what you’re signing up for. Don’t hesitate to ask about loan terms and estimates until everything makes perfect sense. A reputable dental office will happily explain every detail, from your total treatment cost to your exact payment schedule.

You can also request a Good Faith Estimate from your dental provider. This document breaks down all expected charges for your treatment, helping you avoid any billing surprises later.

At Snow Tree Dental, we believe transparency isn’t just nice – it’s essential. We’ll walk you through every aspect of your payment plan, answer all your questions (even the ones you think might be silly), and make sure you feel completely confident about your financial commitment. After all, dental care should improve your life, not stress you out!

Frequently Asked Questions about Dental Payment Plans

We love hearing from our patients, and we’ve noticed some questions come up again and again when discussing payment options. Let’s explore the most common ones – chances are, you’re wondering about these too!

What dental procedures can I finance with a payment plan?

Here’s the wonderful thing about dental places that do payment plans – almost everything can be financed! Whether you’re dealing with an unexpected emergency or finally ready to invest in that smile makeover you’ve been dreaming about, payment plans are designed to make it happen.

Cosmetic treatments are incredibly popular to finance because they’re often not covered by insurance, yet they can transform your confidence. We’re talking about professional teeth whitening, beautiful veneers, and comprehensive smile makeovers. Many patients finance their Invisalign treatment (typically $4,000-$10,000) because it’s such a significant investment in their future self.

When it comes to restorative work, payment plans become even more essential. These procedures aren’t just about looks – they’re about maintaining your oral health and preventing bigger problems down the road. Crowns ($700-$1,400), root canals ($600-$1,500+), and especially dental implants ($3,000-$6,000+ per tooth) are commonly financed because they’re necessary but represent a substantial upfront cost.

Orthodontics is another big category where families rely on payment plans. Whether you choose traditional braces or clear aligners, spreading these costs over time makes it much easier to fit into your monthly budget.

Don’t forget about emergency care – because dental emergencies never seem to happen at convenient times, and they certainly don’t wait for your savings account to be ready! Urgent extractions or emergency root canals can be financed so you get the care you need immediately.

Even general dentistry procedures can be included, especially when they’re part of a larger treatment plan. Sometimes it makes sense to bundle everything together for easier budgeting.

How do payment plans work with my dental insurance?

This is such a smart question because understanding how insurance and payment plans work together can save you money and stress. Think of payment plans as your financial safety net – they catch what your insurance doesn’t cover.

Most dental insurance plans are helpful, but they rarely pay for everything. Your insurance might cover 50% of a crown, leaving you responsible for the other half. Instead of paying that entire remaining amount upfront, a payment plan lets you spread it into comfortable monthly payments.

Deductibles are another area where payment plans shine. Many insurance plans require you to pay a certain amount before they start covering anything. Rather than delaying treatment until you’ve saved up your deductible, you can use a payment plan to get started right away.

The same goes for co-payments – those smaller amounts you pay at each visit. While individually they might seem manageable, they can add up quickly during extensive treatment. Payment plans help you budget for these predictable costs.

For non-covered services like cosmetic dentistry, payment plans become even more valuable. Your insurance might not pay anything toward teeth whitening or veneers, but that doesn’t mean these treatments have to remain out of reach.

At Snow Tree Dental, we’ll always work to maximize your insurance benefits first, then help you set up a payment plan for whatever remains. We want you to understand exactly what you’re paying for and why. You can learn more about how we work with different insurance plans on our insurance information page.

Can I get a dental payment plan with bad credit?

Take a deep breath – this is probably not the roadblock you think it is! While having great credit certainly opens more doors, many patients with less-than-perfect credit still find excellent financing options.

The reality is that life happens. Medical bills, job changes, or other financial challenges can impact your credit score, but that doesn’t mean you should have to live with dental problems. Many dental places that do payment plans understand this and work with patients across the credit spectrum.

Third-party financing companies often have more flexible approval criteria than you might expect. Some patients have been approved with credit scores as low as 600, and companies like Compassionate Finance report approval rates as high as 99%. The key is that you might face higher interest rates as lenders balance their risk, but the monthly payments can still be very manageable.

Working directly with your dental office often provides the most flexibility. In-house payment plans might involve a gentler credit review or focus more on your current ability to make payments rather than past financial difficulties. At Snow Tree Dental, we’re committed to finding solutions that work for real people in real situations.

Many financing applications start with a soft credit check that won’t impact your credit score at all. This lets you see what options are available without any risk. It’s like window shopping – you can see what’s possible before making any commitments.

The most important thing is to be honest about your situation. We’ve helped countless patients find workable solutions, and we’re here to explore every possibility with you. Your oral health is too important to put on hold because of credit concerns.

Conclusion: Take the Next Step Towards an Affordable Smile

We hope this guide has shown you that finding dental places that do payment plans isn’t just possible—it’s actually quite straightforward once you know where to look and what questions to ask. These payment plans are genuine game-changers that put quality dental care within reach for families who might otherwise put off important treatments.

Throughout this journey together, we’ve finded how payment plans empower patients to get the care they need right away. No more waiting months to save up for that root canal or putting off orthodontic treatment because the upfront cost feels overwhelming. These financing options transform what could be a financial burden into manageable monthly payments that fit your budget.

We’ve walked through the practical steps of finding the right dental provider, from starting with your current dentist to searching online and reading patient reviews. We’ve also explored the key differences between in-house plans and third-party financing, helping you understand which option might work best for your situation.

Most importantly, we’ve addressed the real concerns that keep people up at night—questions about credit scores, how insurance works with payment plans, and what procedures can actually be financed. The truth is, there are options for almost everyone, regardless of their financial situation.

Don’t delay necessary care because of cost concerns. Your oral health affects your overall well-being, your confidence, and even your ability to eat comfortably. Putting off treatment often leads to more complex problems that cost significantly more down the road.

As you move forward, remember to research your options thoroughly and ask questions—lots of them. A good dental practice will be transparent about pricing and patient in helping you understand every aspect of your payment plan. There should never be surprises or hidden fees.

Here at Snow Tree Dental in Houston, we’ve built our practice around making quality dental care accessible and convenient for our community. Our commitment to affordable care includes transparent pricing, modern technology for comfortable visits, and flexible scheduling that works around your life—evenings, Saturdays, and even same-day emergencies when needed.

We believe everyone deserves a healthy, confident smile, and we’re here to help you achieve it without financial stress. Ready to explore what’s possible for your smile? Explore your Finance Options today and let’s find a solution that works perfectly for you.